Content

- What does ‘inc.’ mean in a company name?

- Everything You Need To Master Financial Modeling

- Does Retained Earnings Go On The Income Statement?

- Use an income statement to figure out your profit

- Step 3: Add Net Income From the Income Statement

- Terms Similar to the Statement of Retained Earnings

- The Purpose of Retained Earnings

During the same period, the total earnings per share (EPS) was $13.61, while the total dividend paid out by the company was $3.38 per share. The decision to retain the earnings or to distribute how to prepare a retained earnings statement them among shareholders is usually left to the company management. However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company.

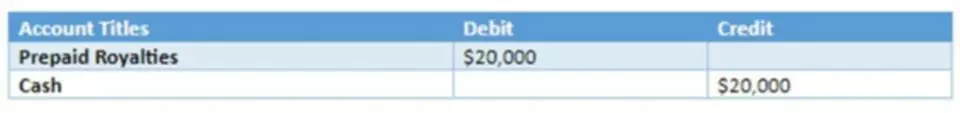

The screenshot below is the income statement of Apple (AAPL) for the fiscal year ending 2022. The dotted red line in the shareholders’ equity section of the balance sheet is where the retained earnings line item can be found. To calculate retained earnings add net income to or subtract any net losses from beginning retained earnings and subtracting any dividends paid to shareholders. Scenario 1 – Bright Ideas Co. starts a new accounting period with $200,000 in retained earnings. After the accounting period ends, the company’s board of directors decides to pay out $20,000 in dividends to shareholders. If a company has a net loss for the accounting period, a company’s retained earnings statement shows a negative balance or deficit.

What does ‘inc.’ mean in a company name?

Remember to interpret retained earnings in the context of your business realities (i.e. seasonality), and you’ll be in good shape to improve earnings and grow your business. For one, retained earnings calculations can yield a skewed perspective when done quarterly. If your business is seasonal, like lawn care or snow removal, your retained earnings may fluctuate substantially from one quarter to the next.

This is because retained earnings provide a more comprehensive overview of the company’s financial stability and long-term growth potential. One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value. It is calculated over a period of time (usually a couple of years) and assesses the change in stock price against the net earnings retained by the company. You can retain earnings, pay a cash dividend to shareholders, or choose a hybrid solution that addresses both of those. The details are up to you, and you should use what you’ve learned here to make smart decisions regarding retained earnings and the future of your business.

Everything You Need To Master Financial Modeling

Additionally, retained earnings can be used to pay down debt or increase dividends to shareholders. There may be times when your business has a positive net income but a negative retained earnings figure (also called an accumulated deficit), or vice versa. Your net income is what’s left at the end of the month after you’ve subtracted your operating expenses from your revenue. Retained earnings are what’s left from your net income after dividends are paid out and beginning retained earnings are factored in.

Retaining earnings can be beneficial for businesses in certain situations. For example, if a company does not need additional funds immediately, it can use its retained earnings to invest in projects that will improve the company’s long-term performance. If not managed carefully, retained earnings can lead to cash flow problems or difficulty obtaining financing. Then, the net income from the current year income statement gets carried over to the statement of retained earnings. If the business suffered a loss, a negative value shows up as net income.

Does Retained Earnings Go On The Income Statement?

It has paid out more in distributions to exactly the same amount as the Owners’ Equity. This is because the equity holder needs to receive his or her money back for this to be a worthwhile investment, that’s all. So a higher retained earnings can mean higher profits or smaller distributions. Retained earnings are usually higher in starts ups when any profits are being retained in the business to reinvest rather than being distributed to the shareholders.

- In this example, $7,500 would be paid out as dividends and subtracted from the current total.

- The other key disadvantage occurs when your retained earnings are too high.

- Add this retained earnings figure of $7,000 to the Q3 balance sheet in the retained earnings section under the equity section.

- In corporate finance, a statement of retained earnings explains changes in the retained earnings balance between accounting periods.

- With this knowledge, managers can make informed decisions about how much money to distribute to shareholders versus keeping within the company.

By subtracting the cash and stock dividends from the net income, the formula calculates the profits a company has retained at the end of the period. If the result is positive, it means the company has added to its retained earnings balance, while a negative result indicates a reduction in retained earnings. Retained Earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate RE, the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period. Retained earnings are a type of equity and are therefore reported in the shareholders’ equity section of the balance sheet.

Use an income statement to figure out your profit

This, of course, depends on whether the company has been pursuing profitable growth opportunities. Traders who look for short-term gains may also prefer dividend payments that offer instant gains. Profits give a lot of room to the business owner(s) or the company management to use the surplus money earned.

The proceeds of a loan would be an example of a nonoperating cash inflow. These earnings are considered “retained” because they have not been distributed to shareholders as dividends but have instead been kept by the company for future use. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance. Retained earnings are shown is the balance sheet within equity and are equal to the amount of net income left over once you have paid out dividends (distributions) to shareholders.

Finally, it can be used to satisfy both long and short-term debt obligations of the business. Since Meow Bots has $95,000 in retained earnings to date, Herbert should hold off on hiring more than one developer. Before Statement of Retained Earnings is created, an Income Statement should have been created first. Similarly, the iPhone maker, whose fiscal year ends in September, had $70.4 billion in retained earnings as of September 2018. Retained earnings also provide your business a cushion against the economic downturn and give you the requisite support to sail through depression.